Emerging sportswear brands are flipping the industry script. In 2024, they’re projected to capture 57% of the sector’s economic profit, skyrocketing from just 20% in 2020 (source: The State of Fashion 2025). Their meteoric rise is fueled by an aggressive 18% compound annual growth rate (CAGR) from 2020 to 2024 and significant profitability improvements, sharply contrasting the 2.4% decline faced by established players (source).

Brands like Hoka, On, and Vuori are leaving industry titans—Nike, Adidas, Puma, and Under Armour—in the dust by focusing on niche markets, embracing cultural authenticity, and differentiating their products.

How Are Upstart Brands Overtaking Industry Giants?

1. Eye-Catching Product Innovations

Emerging brands are investing in striking, functional designs that grab consumer attention. For instance, Hoka’s oversized midsoles offer superior cushioning, while On’s distinctive CloudTec® soles feature pod-like structures. These innovations not only enhance performance but also make a visual statement (source: The State of Fashion 2025).

If your product doesn’t stand out, neither will your brand.

“s your brand investing in designs that are both functional and visually striking?“

2. Mastery of Niche Markets

Instead of battling it out across all sports categories, challenger brands are dominating underserved niches. Lululemon, for example, carved out a significant share in women’s athleisure, while brands like Arc’teryx and Salomon are capturing the hearts of outdoor sports enthusiasts (source).

Numbers that Matter:

• In 2023, women’s sales made up less than 25% of revenues for Nike and Under Armour, a gap that Lululemon exploited to grow to $6 billion by 2021 (source).

Find your niche, and the profits will follow.

Are you targeting markets that big players are overlooking?

3. Authentic Cultural Marketing

Brands like New Balance, Alo Yoga, and Vuori are leveraging celebrity endorsements and grassroots strategies to build authenticity. Hoka collaborates with local running clubs, and Alo Yoga fosters connections with the yoga community (source).

Highlight:

• Grassroots connections, such as Gymshark’s engagement with the gym scene, resonate more deeply than broad, impersonal campaigns (source).

Authenticity isn’t bought—it’s built.

“How genuine are your brand’s connections with its community?”

Balancing Direct-to-Consumer and Wholesale Channels

Both direct-to-consumer (DTC) and wholesale channels are pivotal, each serving distinct purposes.

• DTC Success Stories: Hoka opened a flagship store in New York City in 2024 to host events and share brand stories, while Adidas launched “The Pulse,” a premium outlet format in the UK (source).

• Wholesale Opportunities: Brands like Lululemon expanded into platforms like Zalando, and JD Sports grew through strategic acquisitions. Wholesale-first challengers like On generate 65-70% of their sales through this channel (source).

Reach wide, engage deep.

“Are you balancing your distribution channels to maximize both reach and engagement?”

Amplifying Stories Through Partnerships

Brands are shifting toward more meaningful collaborations to enhance their narratives.

• Emerging Talent: Flexible contracts and equity stakes are attracting rising athletes. For example, Holo Footwear partnered with NBA player Isaac Okoro (source: Biggest Brand Endorsement Deals of 2024).

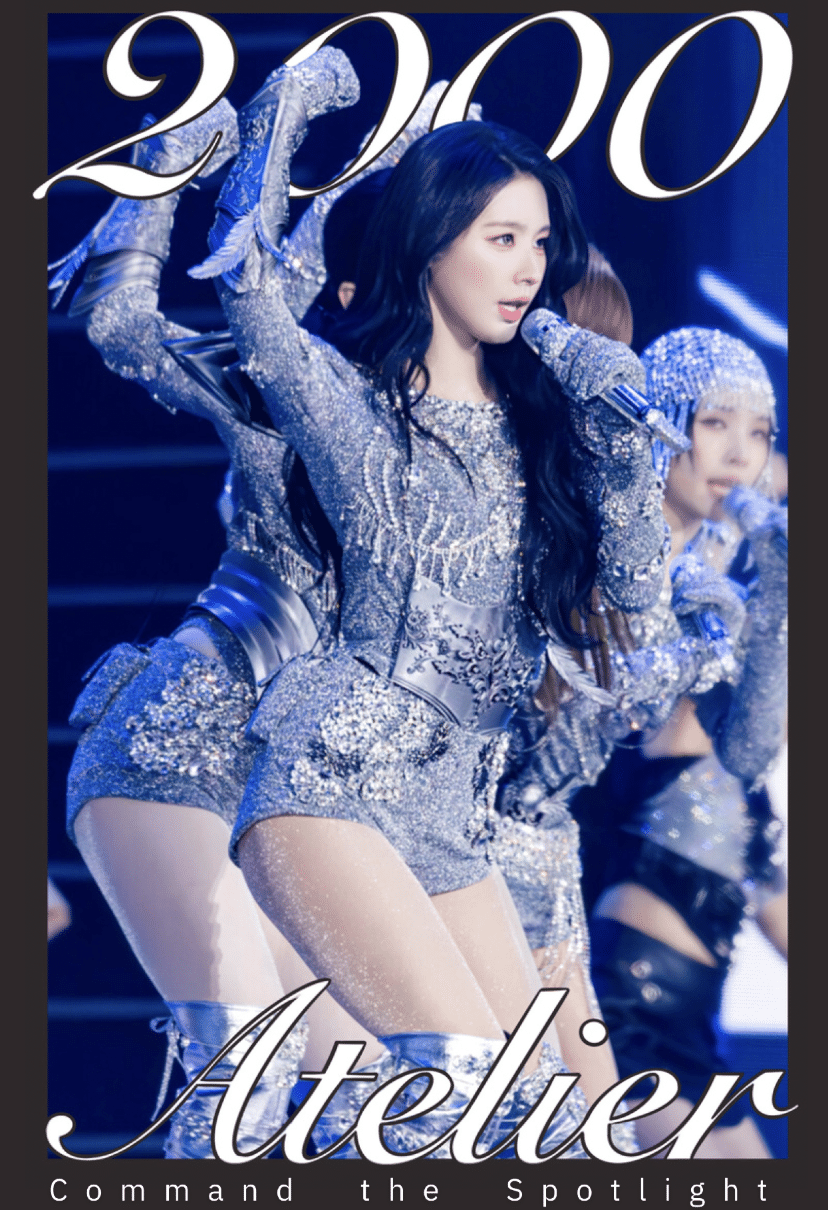

• Celebrity Focus: On’s collaboration with Zendaya emphasizes movement and well-being, while Puma reinvigorated classics with K-pop star Rosé (source).

The right partnership can amplify your story tenfold.

“Do your partnerships align with and enhance your brand narrative?”

Targeting High-Growth Regions

The sportswear market is set to outpace fashion in key regions by 5–6 percentage points in China, 3% in the U.S., and 2–3% in Europe by 2025 (source). Several factors are driving this growth:

• Lifestyle Trends: Two-thirds of Millennials and Gen Z wear athleisure weekly (source).

• Health Prioritization: 56% of Gen Z rank fitness as a top priority (source).

The future wears athleisure.

Are you aligning your products with the lifestyle trends of younger consumers?

Executive Playbook: Priorities for 2024

1. Invest in Innovation: Focus on visible, marketable breakthroughs. Reimagine core products while exploring new categories (source).

• Action Step: Allocate R&D budget toward projects that offer both functional and visual innovation.

2. Double Down on Marketing: Highlight your innovations through targeted campaigns that resonate with niche communities (source).

• Action Step: Develop marketing strategies that engage specific communities rather than broad audiences.

3. Build Authentic Partnerships: Secure emerging athletes early and invest in culturally aligned ambassadors (source).

• Action Step: Identify and collaborate with influencers who genuinely align with your brand values.

4. Strategic Distribution: Utilize DTC channels for engagement and wholesale for expansion, ensuring seamless integration between the two (source: Top 10 Key Learnings from Our Ecommerce Sportswear Report).

• Action Step: Assess your current distribution strategy and adjust to optimize both reach and customer engagement.

Conclusion

The sportswear market is primed for disruption. Challenger brands have set a new standard with visible innovation, niche focus, and cultural authenticity. Whether you’re an incumbent or a newcomer, the roadmap is clear: innovate boldly, engage deeply, and balance your distribution channels to win.

The global sportswear market is projected to grow at a CAGR of 6.5% between 2024 and 2032, reaching $512 billion by 2027 (source: Sportswear Market Report and Forecast 2024–2032). This growth reflects the effectiveness of DTC marketing strategies in building loyal customers and driving sales (source: DTC Marketing: Unveiling the Power of Direct-to-Consumer Strategies). As the industry evolves, brands that adapt to changing consumer preferences and leverage innovative marketing techniques will lead the competitive sportswear landscape.